About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 33 results firms clear search

Finance and Market Concentration Using Agent-Based Modeling: Evidence from South Korea

Yunkyeong Seo Zeynep Elif Altiner Sumin Lee Ilchul Moon Taesub Yun | Published Friday, March 28, 2025Amidst the global trend of increasing market concentration, this paper examines the role of finance

in shaping it. Using Agent-Based Modeling (ABM), we analyze the impact of financial policies on market concentration

and its closely related variables: economic growth and labor income share. We extend the Keynes

meets Schumpeter (K+S) model by incorporating two critical assumptions that influence market concentration.

Policy experiments are conducted with a model validated against historical trends in South Korea. For policy

variables, the Debt-to-Sales Ratio (DSR) limit and interest rate are used as levers to regulate the quantity and

…

Peer reviewed Labor and environment in global value chains: An evolutionary policy study with a three-sector and two-region agent-based macroeconomic model

Lena Gerdes Bernhard Rengs Manuel Scholz-Wäckerle | Published Wednesday, December 22, 2021With this model, we investigate resource extraction and labor conditions in the Global South as well as implications for climate change originating from industry emissions in the North. The model serves as a testbed for simulation experiments with evolutionary political economic policies addressing these issues. In the model, heterogeneous agents interact in a self-organizing and endogenously developing economy. The economy contains two distinct regions – an abstract Global South and Global North. There are three interlinked sectors, the consumption good–, capital good–, and resource production sector. Each region contains an independent consumption good sector, with domestic demand for final goods. They produce a fictitious consumption good basket, and sell it to the households in the respective region. The other sectors are only present in one region. The capital good sector is only found in the Global North, meaning capital goods (i.e. machines) are exclusively produced there, but are traded to the foreign as well as the domestic market as an intermediary. For the production of machines, the capital good firms need labor, machines themselves and resources. The resource production sector, on the other hand, is only located in the Global South. Mines extract resources and export them to the capital firms in the North. For the extraction of resources, the mines need labor and machines. In all three sectors, prices, wages, number of workers and physical capital of the firms develop independently throughout the simulation. To test policies, an international institution is introduced sanctioning the polluting extractivist sector in the Global South as well as the emitting industrial capital good producers in the North with the aim of subsidizing innovation reducing environmental and social impacts.

Peer reviewed Industrial Symbiosis Network implementation ABM

Kasper Pieter Hendrik Lange Gijsbert Korevaar Igor Nikolic Paulien Herder | Published Tuesday, December 01, 2020 | Last modified Wednesday, June 16, 2021The purpose of the model is to explore the influence of actor behaviour, combined with environment and business model design, on the survival rates of Industrial Symbiosis Networks (ISN), and the cash flows of the agents. We define an ISN to be robust, when it is able to run for 10 years, without falling apart due to leaving agents.

The model simulates the implementation of local waste exchange collaborations for compost production, through the ISN implementation stages of awareness, planning, negotiation, implementation, and evaluation.

One central firm plays the role of waste processor in a local composting initiative. This firm negotiates with other firms to become a supplier of their organic residual streams. The waste suppliers in the model can decide to join the initiative, or to have the waste brought to the external waste incinerator. The focal point of the model are the company-level interactions during the implementation or ending of synergies.

…

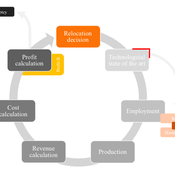

Peer reviewed AUTOMATION-INDUCED RESHORING: An Agent-based Model of the German Manufacturing Industry

Laura Merz | Published Friday, November 20, 2020The agent-based perspective allows insights on how behaviour of firms, guided by simple economic rules on the micro-level, is dynamically influenced by a complex environment in regard to the assumed relocation, decision-making hypotheses. Testing various variables sensitive to initial conditions, increased environmental regulations targeting global trade and upward shifting wage levels in formerly offshore production locations have shown to be driving and inhibiting mechanisms of this socio-technical system. The dynamic demonstrates a shift from predominantly cited economic reasoning for relocation strategies towards sustainability aspects, pressingly changing these realities on an environmental and social dimension. The popular debate is driven by increased environmental awareness and the proclaimed fear of robots killing jobs. In view of reshoring shaping the political agenda, interest in the phenomenon has recently been fuelled by the rise of populism and protectionism.

Peer reviewed Emergent Firms Model

J M Applegate | Published Friday, July 13, 2018The Emergent Firm (EF) model is based on the premise that firms arise out of individuals choosing to work together to advantage themselves of the benefits of returns-to-scale and coordination. The Emergent Firm (EF) model is a new implementation and extension of Rob Axtell’s Endogenous Dynamics of Multi-Agent Firms model. Like the Axtell model, the EF model describes how economies, composed of firms, form and evolve out of the utility maximizing activity on the part of individual agents. The EF model includes a cash-in-advance constraint on agents changing employment, as well as a universal credit-creating lender to explore how costs and access to capital affect the emergent economy and its macroeconomic characteristics such as firm size distributions, wealth, debt, wages and productivity.

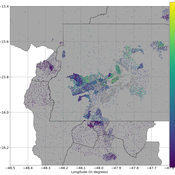

Peer reviewed PolicySpace2: modeling markets and endogenous public policies

Bernardo Furtado | Published Thursday, February 25, 2021 | Last modified Friday, January 14, 2022Policymakers decide on alternative policies facing restricted budgets and uncertain future. Designing public policies is further difficult due to the need to decide on priorities and handle effects across policies. Housing policies, specifically, involve heterogeneous characteristics of properties themselves and the intricacy of housing markets and the spatial context of cities. We propose PolicySpace2 (PS2) as an adapted and extended version of the open source PolicySpace agent-based model. PS2 is a computer simulation that relies on empirically detailed spatial data to model real estate, along with labor, credit, and goods and services markets. Interaction among workers, firms, a bank, households and municipalities follow the literature benchmarks to integrate economic, spatial and transport scholarship. PS2 is applied to a comparison among three competing public policies aimed at reducing inequality and alleviating poverty: (a) house acquisition by the government and distribution to lower income households, (b) rental vouchers, and (c) monetary aid. Within the model context, the monetary aid, that is, smaller amounts of help for a larger number of households, makes the economy perform better in terms of production, consumption, reduction of inequality, and maintenance of financial duties. PS2 as such is also a framework that may be further adapted to a number of related research questions.

Peer reviewed BAM: The Bottom-up Adaptive Macroeconomics Model

Alejandro Guerra-Hernández Alejandro Platas López | Published Tuesday, January 14, 2020 | Last modified Sunday, July 26, 2020Overview

Purpose

Modeling an economy with stable macro signals, that works as a benchmark for studying the effects of the agent activities, e.g. extortion, at the service of the elaboration of public policies..

…

Peer reviewed Strategy with Externalities

J M Applegate Glenn Hoetker | Published Thursday, December 21, 2017The SWE models firms search behaviour as the performance landscape shifts. The shift represents society’s pricing of negative externalities, and the performance landscape is an NK structure. The model is written in NetLogo.

Peer reviewed A Simple Agent-Based Spatial Model of the Economy: Tools for Policy

Bernardo Furtado Isaque Daniel Rocha Eberhardt | Published Tuesday, July 05, 2022This study simulates the evolution of artificial economies in order to understand the tax relevance of administrative boundaries in the quality of life of its citizens. The modeling involves the construction of a computational algorithm, which includes citizens, bounded into families; firms and governments; all of them interacting in markets for goods, labor and real estate. The real estate market allows families to move to dwellings with higher quality or lower price when the families capitalize property values. The goods market allows consumers to search on a flexible number of firms choosing by price and proximity. The labor market entails a matching process between firms (given its location) and candidates, according to their qualification. The government may be configured into one, four or seven distinct sub-national governments, which are all economically conurbated. The role of government is to collect taxes on the value added of firms in its territory and invest the taxes into higher levels of quality of life for residents. The results suggest that the configuration of administrative boundaries is relevant to the levels of quality of life arising from the reversal of taxes. The model with seven regions is more dynamic, but more unequal and heterogeneous across regions. The simulation with only one region is more homogeneously poor. The study seeks to contribute to a theoretical and methodological framework as well as to describe, operationalize and test computer models of public finance analysis, with explicitly spatial and dynamic emphasis. Several alternatives of expansion of the model for future research are described. Moreover, this study adds to the existing literature in the realm of simple microeconomic computational models, specifying structural relationships between local governments and firms, consumers and dwellings mediated by distance.

Knowledge Based Economy

Guido Fioretti Sirio Capizzi Ruggero Rossi Martina Casari Ala Jlif | Published Tuesday, May 18, 2021Knowledge Based Economy (KBE) is an artificial economy where firms placed in geographical space develop original knowledge, imitate one another and eventually recombine pieces of knowledge. In KBE, consumer value arises from the capability of certain pieces of knowledge to bridge between existing items (e.g., Steve Jobs illustrated the first smartphone explaining that you could make a call with it, but also listen to music and navigate the Internet). Since KBE includes a mechanism for the generation of value, it works without utility functions and does not need to model market exchanges.

Displaying 10 of 33 results firms clear search