About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1203 results

A Model of the Gender Cliff in the Relative Contribution to the Household Income

André Grow Jan Van Bavel | Published Wednesday, December 18, 2019In Western countries, the distribution of relative incomes within marriages tends to be skewed in a remarkable way. Husbands usually do not only earn more than their female partners, but there also is a striking discontinuity in their relative contributions to the household income at the 50/50 point: many wives contribute just a bit less than or as much as their husbands, but few contribute more. Our model makes it possible to study a social mechanism that might create this ‘cliff’: women and men differ in their incomes (even outside marriage) and this may differentially affect their abilities to find similar- or higher-income partners. This may ultimately contribute to inequalities within the households that form. The model and associated files make it possible to assess the merit of this mechanism in 27 European countries.

A Balance Model of Opinion Hyperpolarization

Simon Schweighofer Frank Schweitzer David Garcia Simon Schweighofer | Published Tuesday, December 17, 2019 | Last modified Tuesday, December 17, 2019Contains python3 code to replicate the opinion dynamics model from our (so far unpublished) JASSS sumbission “A Balance Model of Opinion Hyperpolarization”. The main function is run_model(), which returns a dictionary object containing various outcome metrics.

Peer reviewed MIOvCWD

Aniruddha Belsare | Published Friday, December 13, 2019MIOvCWD is a spatially-explicit, agent-based model designed to simulate the spread of chronic wasting disease (CWD) in Michigan’s white-tailed deer populations. CWD is an emerging prion disease of North American cervids (white-tailed deer Odocoileus virginianus, mule deer Odocoileus hemionus, and elk Cervus elaphus) that is being actively managed by wildlife agencies in most states and provinces in North America, including Michigan. MIOvCWD incorporates features like deer population structure, social organization and behavior that are particularly useful to simulate CWD dynamics in regional deer populations.

We construct a new type of agent-based model (ABM) that can simultaneously simulate land-use changes at multiple distant places (namely TeleABM, telecoupled agent-based model). We use soybean trade between Brazil and China as an example, where Brazil is the sending system and China is the receiving system because they are the world’s largest soybean exporter and importer respectively. We select one representative county in each country to calibrate and validate the model with spatio-temporal analysis of historical land-use changes and the empirical analysis of household survey data. The whole model is programmed on RePast Simphony. The most unique features of TeleABM are that it can simulate a telecoupled system and the flows between sending and receiving systems in this telecoupled system.

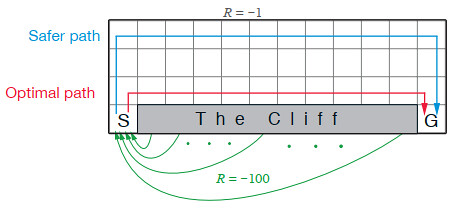

Cliff Walking with Q-Learning NetLogo Extension

Kevin Kons Fernando Santos | Published Tuesday, December 10, 2019This model implements a classic scenario used in Reinforcement Learning problem, the “Cliff Walking Problem”. Consider the gridworld shown below (SUTTON; BARTO, 2018). This is a standard undiscounted, episodic task, with start and goal states, and the usual actions causing movement up, down, right, and left. Reward is -1 on all transitions except those into the region marked “The Cliff.” Stepping into this region incurs a reward of -100 and sends the agent instantly back to the start (SUTTON; BARTO, 2018).

The problem is solved in this model using the Q-Learning algorithm. The algorithm is implemented with the support of the NetLogo Q-Learning Extension

Maze with Q-Learning NetLogo extension

Kevin Kons Fernando Santos | Published Tuesday, December 10, 2019This is a re-implementation of a the NetLogo model Maze (ROOP, 2006).

This re-implementation makes use of the Q-Learning NetLogo Extension to implement the Q-Learning, which is done only with NetLogo native code in the original implementation.

Managing networked landscapes: conservation in fragmented, regionally connected world

Jacopo A. Baggio Michael Schoon Sechindra Vallury | Published Monday, December 09, 2019Exploring how learning and social-ecological networks influence management choice set and their ability to increase the likelihood of species coexistence (i.e. biodiversity) on a fragmented landscape controlled by different managers.

An Agent-based Model of Firm Size Distribution and Collaborative Innovation

Inyoung Hwang | Published Monday, December 09, 2019I added a discounting rate to the equation for expected values of defective / collaborative strategies.

The discounting rate was set to 0.956, the annual average from 1980 to 2015, using the Consumer Price Index (CPI) of Statistics Korea.

Peer reviewed PrioritEvac: An Agent-Based Model of Evacuation from Building Fires

Eileen Young | Published Friday, December 06, 2019This simulation is of the 2003 Station Nightclub Fire and is part of the Interdependencies in Community Resilience (ICoR) project (http://www-personal.umich.edu/~eltawil/icor.html). The git contains the simulation as well as csvs of data about the fire, smoke, building, and people involved.

Rebel Group Protection Rackets

Gerd Wagner Luis Gustavo Nardin Kamil C. Klosek Frances Duffy | Published Wednesday, December 04, 2019System Narrative

How do rebel groups control territory and engage with the local economy during civil war? Charles Tilly’s seminal War and State Making as Organized Crime (1985) posits that the process of waging war and providing governance resembles that of a protection racket, in which aspiring governing groups will extort local populations in order to gain power, and civilians or businesses will pay in order to ensure their own protection. As civil war research increasingly probes the mechanisms that fuel local disputes and the origination of violence, we develop an agent-based simulation model to explore the economic relationship of rebel groups with local populations, using extortion racket interactions to explain the dynamics of rebel fighting, their impact on the economy, and the importance of their economic base of support. This analysis provides insights for understanding the causes and byproducts of rebel competition in present-day conflicts, such as the cases of South Sudan, Afghanistan, and Somalia.

Model Description

The model defines two object types: RebelGroup and Enterprise. A RebelGroup is a group that competes for power in a system of anarchy, in which there is effectively no government control. An Enterprise is a local civilian-level actor that conducts business in this environment, whose objective is to make a profit. In this system, a RebelGroup may choose to extort money from Enterprises in order to support its fighting efforts. It can extract payments from an Enterprise, which fears for its safety if it does not pay. This adds some amount of money to the RebelGroup’s resources, and they can return to extort the same Enterprise again. The RebelGroup can also choose to loot the Enterprise instead. This results in gaining all of the Enterprise wealth, but prompts the individual Enterprise to flee, or leave the model. This reduces the available pool of Enterprises available to the RebelGroup for extortion. Following these interactions the RebelGroup can choose to AllocateWealth, or pay its rebel fighters. Depending on the value of its available resources, it can add more rebels or expel some of those which it already has, changing its size. It can also choose to expand over new territory, or effectively increase its number of potential extorting Enterprises. As a response to these dynamics, an Enterprise can choose to Report expansion to another RebelGroup, which results in fighting between the two groups. This system shows how, faced with economic choices, RebelGroups and Enterprises make decisions in war that impact conflict and violence outcomes.

Displaying 10 of 1203 results