About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 29 results capital clear search

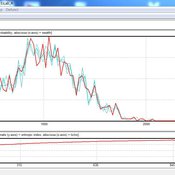

An Agent Based Model of International Capital Flows

Harvey Baldovino | Published Thursday, April 06, 2023This is a preliminary attempt in creating an Agent-Based Model of capital flows. This is based on the theory of capital flows based on interest-rate differentials. Foreign capital flows to a country with higher interest rates relative to another. The model shows how capital volatilty and wealth concentration are affected by the speed of capital flow, number of investors, magnitude of changes in interest rate due to capital flows and the interest differential threshold that investors set in deciding whether to move capital or not. Investors in the model are either “regional” investors (only investing in neighboring countries) and “global” investors (those who invest anywhere in the world).

In the future, the author hopes to extend this model to incorporate capital flow based on changes in macroeconomic fundamentals, exchange rate volatility, behavioral finance (for instance, herding behavior) and the presence of capital controls.

A model of the emergence of intersectional life course inequalities through transitions in the workplace. It explores LGBTQ citizens’ career outcomes and trajectories in relation to several mediating factors: (i) workplace discrimination; (ii) social capital; (iii) policy interventions (i.e., workplace equality, diversity, and inclusion policies); (iv) and LGBTQ employees’ behaviours in response to discrimination (i.e., moving workplaces and/or different strategies for managing the visibility of their identity).

SimPioN - Simulating Path dependence in inter-organisational Networks

Frithjof Stöppler Nanda Wijermans | Published Monday, January 11, 2021The SimPioN model aims to abstractly reproduce and experiment with the conditions under which a path-dependent process may lead to a (structural) network lock-in in interorganisational networks.

Path dependence theory is constructed around a process argumentation regarding three main elements: a situation of (at least) initially non-ergodic (unpredictable with regard to outcome) starting conditions in a social setting; these become reinforced by the workings of (at least) one positive feedback mechanism that increasingly reduces the scope of conceivable alternative choices; and that process finally results in a situation of lock-in, where any alternatives outside the already adopted options become essentially impossible or too costly to pursue despite (ostensibly) better options theoretically being available.

The purpose of SimPioN is to advance our understanding of lock-ins arising in interorganisational networks based on the network dynamics involving the mechanism of social capital. This mechanism and the lock-ins it may drive have been shown above to produce problematic consequences for firms in terms of a loss of organisational autonomy and strategic flexibility, especially in high-tech knowledge-intensive industries that rely heavily on network organising.

…

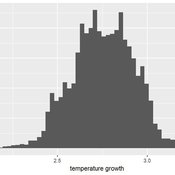

Agent Based Integrated Assessment Model

Marcin Czupryna | Published Saturday, June 27, 2020Agent based approach to the class of the Integrated Assessment Models. An agent-based model (ABM) that focuses on the energy sector and climate relevant facts in a detailed way while being complemented with consumer goods, labour and capital markets to a minimal necessary extent.

Emergence of Small-World Networks in an Overlapping-Generations Model of Social Dynamics, Trust and Economic Performance

Bogumił Kamiński Jakub Growiec Katarzyna Growiec | Published Thursday, February 27, 2020We study the impact of endogenous creation and destruction of social ties in an artificial society on aggregate outcomes such as generalized trust, willingness to cooperate, social utility and economic performance. To this end we put forward a computational multi-agent model where agents of overlapping generations interact in a dynamically evolving social network. In the model, four distinct dimensions of individuals’ social capital: degree, centrality, heterophilous and homophilous interactions, determine their generalized trust and willingness to cooperate, altogether helping them achieve certain levels of social utility (i.e., utility from social contacts) and economic performance. We find that the stationary state of the simulated social network exhibits realistic small-world topology. We also observe that societies whose social networks are relatively frequently reconfigured, display relatively higher generalized trust, willingness to cooperate, and economic performance – at the cost of lower social utility. Similar outcomes are found for societies where social tie dissolution is relatively weakly linked to family closeness.

00b SimEvo_V5.08 NetLogo

Garvin Boyle | Published Saturday, October 05, 2019In 1985 Dr Michael Palmiter, a high school teacher, first built a very innovative agent-based model called “Simulated Evolution” which he used for teaching the dynamics of evolution. In his model, students can see the visual effects of evolution as it proceeds right in front of their eyes. Using his schema, small linear changes in the agent’s genotype have an exponential effect on the agent’s phenotype. Natural selection therefore happens quickly and effectively. I have used his approach to managing the evolution of competing agents in a variety of models that I have used to study the fundamental dynamics of sustainable economic systems. For example, here is a brief list of some of my models that use “Palmiter Genes”:

- ModEco - Palmiter genes are used to encode negotiation strategies for setting prices;

- PSoup - Palmiter genes are used to control both motion and metabolic evolution;

- TpLab - Palmiter genes are used to study the evolution of belief systems;

- EffLab - Palmiter genes are used to study Jevon’s Paradox, EROI and other things.

…

06b EiLab_Model_I_V5.00 NL

Garvin Boyle | Published Saturday, October 05, 2019EiLab - Model I - is a capital exchange model. That is a type of economic model used to study the dynamics of modern money which, strangely, is very similar to the dynamics of energetic systems. It is a variation on the BDY models first described in the paper by Dragulescu and Yakovenko, published in 2000, entitled “Statistical Mechanics of Money”. This model demonstrates the ability of capital exchange models to produce a distribution of wealth that does not have a preponderance of poor agents and a small number of exceedingly wealthy agents.

This is a re-implementation of a model first built in the C++ application called Entropic Index Laboratory, or EiLab. The first eight models in that application were labeled A through H, and are the BDY models. The BDY models all have a single constraint - a limit on how poor agents can be. That is to say that the wealth distribution is bounded on the left. This ninth model is a variation on the BDY models that has an added constraint that limits how wealthy an agent can be? It is bounded on both the left and right.

EiLab demonstrates the inevitable role of entropy in such capital exchange models, and can be used to examine the connections between changing entropy and changes in wealth distributions at a very minute level.

…

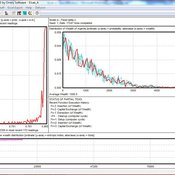

06 EiLab V1.40 – Entropic Index Laboratory

Garvin Boyle | Published Monday, March 19, 2018There is a new type of economic model called a capital exchange model, in which the biophysical economy is abstracted away, and the interaction of units of money is studied. Benatti, Drăgulescu and Yakovenko described at least eight capital exchange models – now referred to collectively as the BDY models – which are replicated as models A through H in EiLab. In recent writings, Yakovenko goes on to show that the entropy of these monetarily isolated systems rises to a maximal possible value as the model approaches steady state, and remains there, in analogy of the 2nd law of thermodynamics. EiLab demonstrates this behaviour. However, it must be noted that we are NOT talking about thermodynamic entropy. Heat is not being modeled – only simple exchanges of cash. But the same statistical formulae apply.

In three unpublished papers and a collection of diary notes and conference presentations (all available with this model), the concept of “entropic index” is defined for use in agent-based models (ABMs), with a particular interest in sustainable economics. Models I and J of EiLab are variations of the BDY model especially designed to study the Maximum Entropy Principle (MEP – model I) and the Maximum Entropy Production Principle (MEPP – model J) in ABMs. Both the MEPP and H.T. Odum’s Maximum Power Principle (MPP) have been proposed as organizing principles for complex adaptive systems. The MEPP and the MPP are two sides of the same coin, and an understanding of their implications is key, I believe, to understanding economic sustainability. Both of these proposed (and not widely accepted) principles describe the role of entropy in non-isolated systems in which complexity is generated and flourishes, such as ecosystems, and economies.

EiLab is one of several models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, and CmLab.

06 EiLab V1.36 – Entropic Index Laboratory

Garvin Boyle | Published Saturday, January 31, 2015 | Last modified Friday, April 14, 2017EiLab explores the role of entropy in simple economic models. EiLab is one of several models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, and CmLab.

An agent-based model to simulate the impact of developers’ capital possession on urban development

Agung Wahyudi | Published Saturday, June 23, 2018The model combines agent-based modelling and microeconomic approach to simulate the decision behaviour of land developers and how this impacts on the spatio-temporal processes of urban expansion.

Displaying 10 of 29 results capital clear search