About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 922 results for "Chantal van Esch" clear search

ICARUS - a multi-agent compliance inspection model

Slaven Smojver | Published Monday, May 09, 2022ICARUS is a multi-agent compliance inspection model (ICARUS - Inspecting Compliance to mAny RUleS). The model is applicable to environments where an inspection agency, via centrally coordinated inspections, examines compliance in organizations which must comply with multiple provisions (rules). The model (ICARUS) contains 3 types of agents: entities, inspection agency and inspectors / inspections. ICARUS describes a repeated, simultaneous, non-cooperative game of pure competition. Agents have imperfect, incomplete, asymmetric information. Entities in each move (tick) choose a pure strategy (comply/violate) for each rule, depending on their own subjective assessment of the probability of the inspection. The Inspection Agency carries out the given inspection strategy.

A more detailed description of the model is available in the .nlogo file.

Full description of the model (in line with the ODD+D protocol) and the analysis of the model (including verification, validation and sensitivity analysis) can be found in the attached documentation.

ED simulation

Emilio Sulis | Published Sunday, October 15, 2017The functioning of an hospital ED. The use case concerns an hospital in Italy which is moving in a new building. Simulations interest both new and old department, to investigate changes by exploring KPIs.

Interplay between stakeholders of the management of a river

Christophe Sibertin-Blanc Pascal Roggero Bertrand Baldet | Published Wednesday, November 12, 2014This model describes and analyses the outcomes of the confrontation of interests, some conflicting, some common, about the management of a small river in SW France

We propose here a computational model of school segregation that is aligned with a corresponding Schelling-type model of residential segregation. To adapt the model for application to school segregation, we move beyond previous work by combining two preference arguments in modeling parents’ school choice, preferences for the ethnic composition of a school and preferences for minimizing the travelling distance to the school.

An Agent-Based Model of an Insurer's Estimated Capital Requirement in a Simple Insurance Market with Imperfect Information in C#

Rei England | Published Sunday, September 24, 2023This is an agent-based model of a simple insurance market with two types of agents: customers and insurers. Insurers set premium quotes for each customer according to an estimation of their underlying risk based on past claims data. Customers either renew existing contracts or else select the cheapest quote from a subset of insurers. Insurers then estimate their resulting capital requirement based on a 99.5% VaR of their aggregate loss distributions. These estimates demonstrate an under-estimation bias due to the winner’s curse effect.

AMIRIS

Kristina Nienhaus Christoph Schimeczek Ulrich Frey Evelyn Sperber Seyedfarzad Sarfarazi Felix Nitsch Johannes Kochems Aboubakr Achraf El Ghazi | Published Thursday, February 03, 2022AMIRIS is the Agent-based Market model for the Investigation of Renewable and Integrated energy Systems.

It is an agent-based simulation of electricity markets and their actors.

AMIRIS enables researches to analyse and evaluate energy policy instruments and their impact on the actors involved in the simulation context.

Different prototypical agents on the electricity market interact with each other, each employing complex decision strategies.

AMIRIS allows to calculate the impact of policy instruments on economic performance of power plant operators and marketers.

…

Sensitivity of the Deffuant model to measurement error

Dino Carpentras | Published Monday, June 07, 2021This code can be used to analyze the sensitivity of the Deffuant model to different measurement errors. Specifically to:

- Intrinsic stochastic error

- Binning of the measurement scale

- Random measurement noise

- Psychometric distortions

…

Cyberworld 1

Dmitry Brizhinev Nathan Ryan Roger Bradbury | Published Thursday, April 23, 2015 | Last modified Sunday, February 25, 2018A Repast Simphony model of interactions (conflict and cooperation) between states

Exploring organizational learning in innovation networks. An agent-based model

Sandra Schmid | Published Saturday, March 07, 2015This agent-based model represents a stylized inter-organizational innovation network where firms collaborate with each other in order to generate novel organizational knowledge.

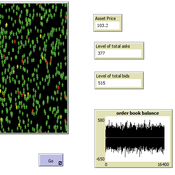

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

Displaying 10 of 922 results for "Chantal van Esch" clear search