About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 770 results for "Momme Von Sydow" clear search

Collective Decision Making for Ecological Restoration

Dean Massey Moira Zellner Cristy Watkins Jeremy Brooks Kristen Ross | Published Friday, December 30, 2011 | Last modified Friday, November 21, 2014We present an agent-based model that maps out and simulates the processes by which individuals within ecological restoration organizations communicate and collectively make restoration decisions.

CoComForest

Wuthiwong WIMOLSAKCHAROEN | Published Tuesday, February 02, 2021The name of the model, CoComForest, stands for COllaborative COMmunity FOREST management. The purposes of this model are to expose local resource harvesters to the competition with external resource harvesters, called outsiders, and to provide them the opportunity to collectively discuss on resource management. The model, which is made of a set of interconnected entities, including (i) community forest habitat, (ii) resource harvesters, (iii) market, and (iv) firebreak. More details about the CoComForest model are described based on the Overview, Design concept, and Details (ODD) protocol uploaded with the model.

Agent-based simulation of discussion processes in risk workshops with quantitative skepticism

Matthias Meyer Clemens Harten Lucia Bellora-Bienengräber | Published Sunday, August 14, 2022The model measures drivers of effectiveness of risk assessments in risk workshops where a calculative culture of quantitative skepticism is present. We model the limits to information transfer, incomplete discussions, group characteristics, and interaction patterns and investigate their effect on risk assessment in risk workshops, in order to contrast results to a previous model focused on a calculative culture of quantitative enthusiasm.

The model simulates a discussion in the context of a risk workshop with 9 participants. The participants use constraint satisfaction networks to assess a given risk individually and as a group.

A Simulation Model of the Radicalisation Process

Rosemary Pepys | Published Saturday, November 16, 2019This is the code for a simulation model of the radicalisation process based on the IVEE theoretical framework.

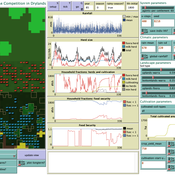

Peer reviewed LUCID: Land Use Competition In Drylands

Birgit Müller Gunnar Dressler Lance Robinson | Published Wednesday, April 12, 2023The Land Use Competition in Drylands (LUCID) model is a stylized agent-based model of a smallholder farming system. Its main purpose is to illustrate how competition between pastoralism and crop cultivation can affect livelihoods of households, specifically their food security. In particular, the model analyzes whether the expansion of crop cultivation may contribute to a vicious circle where an increase in cultivated area leads to higher grazing pressure on the remaining pastureland, which in turn may cause forage shortages and livestock loss for households which are then forced to further expand their cultivated area in order to increase their food security. The model does not attempt to replicate a particular case study but to generate a general understanding of mechanisms and drivers of such vicious circles and to identify possible scenarios under which such circles may be prevented.

The model is inspired by observations of the Borana land use system in Southern Ethiopia. The climatic and ecological conditions of the Borana zone favor pastoralism, and traditionally livelihoods have been based mainly on livestock keeping. Recent years, however, have seen an advancement of crop cultivation as a coping strategy, e.g., to compensate the loss of livestock, even though crop yields are low on average and successful harvests are infrequent.

In the model, it is possible to evaluate patterns of individual (single household) as well as overall (across all households) consumption and food security, depending on a range of ecological, climatic and management parameters.

Agent-Based Model of a Circular Food Packaging Ecosystem to assess Packaging Waste Dynamics

Annoek Reitsema | Published Friday, October 11, 2024Reducing packaging waste is a critical challenge that requires organizations to collaborate within circular ecosystems, considering social, economic, and technical variables like decision-making behavior, material prices, and available technologies. Agent-Based Modeling (ABM) offers a valuable methodology for understanding these complex dynamics. In our research, we have developed an ABM to explore circular ecosystems’ potential in reducing packaging waste, using a case study of the Dutch food packaging ecosystem. The model incorporates three types of agents—beverage producers, packaging producers, and waste treaters—who can form closed-loop recycling systems.

Beverage Producer Agents: These agents represent the beverage company divided into five types based on packaging formats: cans, PET bottles, glass bottles, cartons, and bag-in-boxes. Each producer has specific packaging demands based on product volume, type, weight, and reuse potential. They select packaging suppliers annually, guided by deterministic decision styles: bargaining (seeking the lowest price) or problem-solving (prioritizing high recycled content).

Packaging Producer Agents: These agents are responsible for creating packaging using either recycled or virgin materials. The model assumes a mix of monopolistic and competitive market situations, with agents calculating annual material needs. Decision styles influence their choices: bargaining agents compare recycled and virgin material costs, while problem-solving agents prioritize maximum recycled content. They calculate recycled content in packaging and set prices accordingly, ensuring all produced packaging is sold within or outside the model.

…

Simulation Experiments of "The dynamics of corruption under an optional external supervision service"

Xin Zhou | Published Wednesday, June 21, 2023The simulation experiment is for studying the influence of external supervision services on combating corruption.

Algorithm: evolutionary game theory

GODS: Gossip-Oriented Dilemma Simulator

Jan Majewski | Published Wednesday, September 04, 2024Model of influence of access to social information spread via social network on decisions in a two-person game.

06b EiLab_Model_I_V5.00 NL

Garvin Boyle | Published Saturday, October 05, 2019EiLab - Model I - is a capital exchange model. That is a type of economic model used to study the dynamics of modern money which, strangely, is very similar to the dynamics of energetic systems. It is a variation on the BDY models first described in the paper by Dragulescu and Yakovenko, published in 2000, entitled “Statistical Mechanics of Money”. This model demonstrates the ability of capital exchange models to produce a distribution of wealth that does not have a preponderance of poor agents and a small number of exceedingly wealthy agents.

This is a re-implementation of a model first built in the C++ application called Entropic Index Laboratory, or EiLab. The first eight models in that application were labeled A through H, and are the BDY models. The BDY models all have a single constraint - a limit on how poor agents can be. That is to say that the wealth distribution is bounded on the left. This ninth model is a variation on the BDY models that has an added constraint that limits how wealthy an agent can be? It is bounded on both the left and right.

EiLab demonstrates the inevitable role of entropy in such capital exchange models, and can be used to examine the connections between changing entropy and changes in wealth distributions at a very minute level.

…

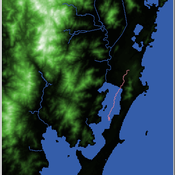

Shellmound Mobility

Henrique de Sena Kozlowski | Published Saturday, June 15, 2024Least Cost Path (LCP) analysis is a recurrent theme in spatial archaeology. Based on a cost of movement image, the user can interpret how difficult it is to travel around in a landscape. This kind of analysis frequently uses GIS tools to assess different landscapes. This model incorporates some aspects of the LCP analysis based on GIS with the capabilities of agent-based modeling, such as the possibility to simulate random behavior when moving. In this model the agent will travel around the coastal landscape of Southern Brazil, assessing its path based on the different cost of travel through the patches. The agents represent shellmound builders (sambaquieiros), who will travel mainly through the use of canoes around the lagoons.

How it works?

When the simulation starts the hiker agent moves around the world, a representation of the lagoon landscape of the Santa Catarina state in Southern Brazil. The agent movement is based on the travel cost of each patch. This travel cost is taken from a cost surface raster created in ArcMap to represent the different cost of movement around the landscape. Each tick the agent will have a chance to select the best possible patch to move in its Field of View (FOV) that will take it towards its target destination. If it doesn’t select the best possible patch, it will randomly choose one of the patches to move in its FOV. The simulation stops when the hiker agent reaches the target destination. The elevation raster file and the cost surface map are based on a 1 Arc-second (30m) resolution SRTM image, scaled down 5 times. Each patch represents a square of 150m, with an area of 0,0225km². The dataset uses a UTM Sirgas 2000 22S projection system. There are four different cost functions available to use. They change the cost surface used by the hikers to navigate around the world.

Displaying 10 of 770 results for "Momme Von Sydow" clear search