About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 343 results for "Tim Dorscheidt" clear search

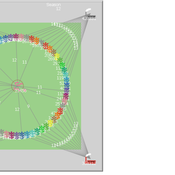

Peer reviewed Circular Business Model experimentation: local biodigestion network

Igor Nikolic Kasper Pieter Hendrik Lange Gijsbert Korevaar Paulien Herder | Published Thursday, December 17, 2020 | Last modified Tuesday, June 29, 2021The purpose of the model is to explore the influence of the design of circular business models (CBMs) on CBM viability. The model represents an Industrial Symbiosis Network (ISN) in which a processor uses the organic waste from suppliers to produce biogas and nutrient rich digestate for local reuse. CBM viability is expressed as value captured (e.g., cash flow/tonne waste/agent) and the survival of the network over time (shown in the interface).

In the model, the value captured is calculated relative to the initial state, using incineration costs as a benchmark. Moderating variables are interactions with the waste incinerator and actor behaviour factors. Actors may leave the network when the waste supply for local production is too low, or when personal economic benefits are too low. When the processor decides to leave, the network fails. Theory of planned behaviour can be used to include agent behaviour in the simulations.

A replication and extension of the Taylor's Simulation Model of Insurance Market Dynamics in C#

Rei England | Published Sunday, September 24, 2023A simple model is constructed using C# in order to to capture key features of market dynamics, while also producing reasonable results for the individual insurers. A replication of Taylor’s model is also constructed in order to compare results with the new premium setting mechanism. To enable the comparison of the two premium mechanisms, the rest of the model set-up is maintained as in the Taylor model. As in the Taylor example, homogeneous customers represented as a total market exposure which is allocated amongst the insurers.

In each time period, the model undergoes the following steps:

1. Insurers set competitive premiums per exposure unit

2. Losses are generated based on each insurer’s share of the market exposure

3. Accounting results are calculated for each insurer

…

This agent-based model (ABM), developed in NetLogo and available on the COMSES repository, simulates a stylized, competitive electricity market to explore the effects of carbon pricing policies under conditions of technological innovation. Unlike traditional models that treat innovation as exogenous, this ABM incorporates endogenous innovation dynamics, allowing clean technology costs to evolve based on cumulative deployment (Wright’s Law) or time (Moore’s Law). Electricity generation companies act as agents, making investment decisions across coal, gas, wind, and solar PV technologies based on expected returns and market conditions. The model evaluates three policy scenarios—No Policy, Emissions Trading System (ETS), and Carbon Tax—within a merit-order market framework. It is partially empirically grounded, using real-world data for technology costs and emissions caps. By capturing emergent system behavior, this model offers a flexible and transparent tool for analyzing the transition to low-carbon electricity systems.

An agent-based model exploring the biodiversity-agriculture-nutrition dynamics in Eastern Madagascar resulting from alternative land uses

Romain Clercq-Roques Jessica Williams Katja Perez Guzman Marta Kozicka Kristine Belesova Zaid Chalabi | Published Wednesday, July 23, 2025This agent-based model simulates the interactions between smallholder farming households, land-use dynamics, and ecosystem services in a rural landscape of Eastern Madagascar. It explores how alternative agricultural practices —shifting agriculture, rice cultivation, and agroforestry—combined with varying levels of forest protection, influence food production, food security, dietary diversity, and forest biodiversity over time. The landscape is represented as a grid of spatially explicit patches characterized by land use, ecological attributes, and regeneration dynamics. Agents make yearly decisions on land management based on demographic pressures, agricultural returns, and institutional constraints. Crop yields are affected by stochastic biotic and abiotic disruptions, modulated by local ecosystem regulation functions. The model additionally represents foraging as a secondary food source and pressure on biodiversity. The model supports the analysis of long-term trade-offs between agricultural productivity, human nutrition, and conservation under different policy and land-use scenarios.

Spatiotemporal Visualization of Emotional and Emotional-related Mental States

Luis Macedo | Published Monday, November 07, 2011 | Last modified Saturday, April 27, 2013A system that receives from an agent-based social simulation the agent’s emotional data, their emotional-related data such as motivations and beliefs, as well as their location, and visualizes of all this information in a two dimensional map of the geographic region the agents inhabit as well as on graphs along the time dimension.

Mast seeding model

Giangiacomo Bravo Lucia Tamburino | Published Saturday, September 08, 2012 | Last modified Saturday, April 27, 2013Purpose of the model is to perform a “virtual experiment” to test the predator satiation hypothesis, advanced in literature to explain the mast seeding phenomenon.

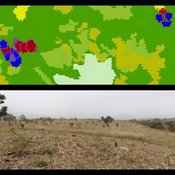

MoPAgrIB: simulating savannah landscape mosaic under shifting cultivation

Nicolas Becu Marc Deconchat Eric Garine Kouami Kokou Christine Raimond | Published Monday, May 27, 2013 | Last modified Tuesday, January 21, 2014MoPAgrIB model simulates the movement of cultivated patches in a savannah vegetation mosaic ; how they move and relocate through the landscape, depending on farming practices, population growth, social rules and vegetation growth.

Social norms and the dominance of Low-doers

Antonio Franco | Published Wednesday, July 13, 2016 | Last modified Sunday, December 02, 2018The code for the paper “Social norms and the dominance of Low-doers”

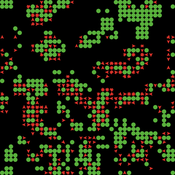

A spatial model of resource-consumer dynamics

Arend Ligtenberg Guus Ten Broeke George Ak Van Voorn Jaap Molenaar | Published Wednesday, January 11, 2017 | Last modified Thursday, September 17, 2020The model simulates agents in a spatial environment competing for a common resource that grows on patches. The resource is converted to energy, which is needed for performing actions and for surviving.

Mesoscopic Effects in an Agent-Based Bargaining Model in Regular Lattices

David Poza José Manuel Galán Ordax José Santos Adolfo López-Paredes | Published Thursday, February 02, 2017 | Last modified Wednesday, April 25, 2018We propose an agent-based model where a fixed finite population of tagged agents play iteratively the Nash demand game in a regular lattice. The model extends the bargaining model by Axtell, Epstein and Young.

Displaying 10 of 343 results for "Tim Dorscheidt" clear search