About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 227 results for "Marcel Volosin" clear search

Sharing economy in the short-time accommodations market

Bruna Bruno Marisa Faggini | Published Wednesday, October 16, 2019We present an agent-based model for the sharing economy, in the short-time accommodations market, where peers participating as suppliers and demanders follow simple decision rules about sharing market participation, according to their heterogeneous characteristics. We consider the sharing economy mainly as a peer-to-peer market where the access is preferred to ownership, excluding professional agents using sharing platforms as Airbnb to promote their business.

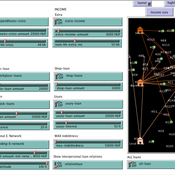

Peer reviewed Credit and debt market of low-income families

Márton Gosztonyi | Published Tuesday, December 12, 2023 | Last modified Friday, January 19, 2024The purpose of the Credit and debt market of low-income families model is to help the user examine how the financial market of low-income families works.

The model is calibrated based on real-time data which was collected in a small disadvantaged village in Hungary it contains 159 households’ social network and attributes data.

The simulation models the households’ money liquidity, expenses and revenue structures as well as the formal and informal loan institutions based on their network connections. The model forms an intertwined system integrated in the families’ local socioeconomic context through which families handle financial crises and overcome their livelihood challenges from one month to another.

The simulation-based on the abstract model of low-income families’ financial survival system at the bottom of the pyramid, which was described in following the papers:

…

Toward Market Structure as a Complex System: A Web Based Simulation Assignment Implemented in Netlogo

Timothy Kochanski | Published Monday, February 14, 2011 | Last modified Saturday, April 27, 2013This is the model for a paper that is based on a simulation model, programmed in Netlogo, that demonstrates changes in market structure that occur as marginal costs, demand, and barriers to entry change. Students predict and observe market structure changes in terms of number of firms, market concentration, market price and quantity, and average marginal costs, profits, and markups across the market as firms innovate. By adjusting the demand growth and barriers to entry, students can […]

Finance and Market Concentration Using Agent-Based Modeling: Evidence from South Korea

Yunkyeong Seo Zeynep Elif Altiner Sumin Lee Ilchul Moon Taesub Yun | Published Friday, March 28, 2025Amidst the global trend of increasing market concentration, this paper examines the role of finance

in shaping it. Using Agent-Based Modeling (ABM), we analyze the impact of financial policies on market concentration

and its closely related variables: economic growth and labor income share. We extend the Keynes

meets Schumpeter (K+S) model by incorporating two critical assumptions that influence market concentration.

Policy experiments are conducted with a model validated against historical trends in South Korea. For policy

variables, the Debt-to-Sales Ratio (DSR) limit and interest rate are used as levers to regulate the quantity and

…

Generic servicising model (SPREE project)

Reinier Van Der Veen Kasper H Kisjes Igor Nikolic | Published Wednesday, August 26, 2015 | Last modified Wednesday, September 28, 2016This generic agent-based model allows the user to simulate and explore the influence of servicising policies on the uptake of servicising and on economic, environmental and social effects, notably absolute decoupling.

The Agent-Based Model of the Closed Market( similar to Stock Market) with One Commodity and with careful and risky mechanisms

Mark Voronovitsky | Published Sunday, March 15, 2015 | Last modified Sunday, March 22, 2015The model of market of one commodity , in which there are in each moment of time the same quantity and the same quantity of money was formulated and researched in this text. We also study this system as a game of automata.

ABSAM model

Marcin Wozniak | Published Monday, August 29, 2016 | Last modified Tuesday, November 08, 2016ABSAM model is an agent-based search and matching model of the local labor market. There are four types of agents in the economy, which cooperate in the artificial world, where behavioral rules were extracted from the labor market search theory.

On the liquidity of the illiquid (hard-to-trade) assets

Marcin Czupryna | Published Monday, January 13, 2025This paper investigates the impact of agents' trading decisions on market liquidity and transactional efficiency in markets for illiquid (hard-to-trade) assets. Drawing on a unique order book dataset from the fine wine exchange Liv-ex, we offer novel insights into liquidity dynamics in illiquid markets. Using an agent-based framework, we assess the adequacy of conventional liquidity measures in capturing market liquidity and transactional efficiency. Our main findings reveal that conventional liquidity measures, such as the number of bids, asks, new bids and new asks, may not accurately represent overall transactional efficiency. Instead, volume (measured by the number of trades) and relative spread measures may be more appropriate indicators of liquidity within the context of illiquid markets. Furthermore, our simulations demonstrate that a greater number of traders participating in the market correlates with an increased efficiency in trade execution, while wider trader-set margins may decrease the transactional efficiency. Interestingly, the trading period of the agents appears to have a significant impact on trade execution. This suggests that granting market participants additional time for trading (for example, through the support of automated trading systems) can enhance transactional efficiency within illiquid markets. These insights offer practical implications for market participants and policymakers aiming to optimise market functioning and liquidity.

Evaluating Government's Policies on Promoting Smart Metering Diffusion in Retail Electricity Markets

Tao Zhang | Published Monday, December 07, 2009 | Last modified Saturday, April 27, 2013This model is a market game for evaluating the effectiveness of the UK government’s 2008-2010 policy on promoting smart metering in the UK retail electricity market. We break down the policy into four

Metaphoria 2019

Timothy Gooding | Published Sunday, February 24, 2019This model test the efficiency of the market economy in comparison with a hunter/gatherer economy. It also compares the model outcomes between a market economy when using eternal agents with one using mortal agents.

Displaying 10 of 227 results for "Marcel Volosin" clear search