About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 219 results for "Martin Neumann" clear search

Peer reviewed HUMLAND: HUMan impact on LANDscapes agent-based model

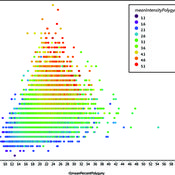

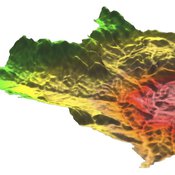

Fulco Scherjon Anastasia Nikulina Anhelina Zapolska Maria Antonia Serge Marco Davoli Dave van Wees Katharine MacDonald | Published Monday, October 16, 2023The HUMan impact on LANDscapes (HUMLAND) model has been developed to track and quantify the intensity of different impacts on landscapes at the continental level. This agent-based model focuses on determining the most influential factors in the transformation of interglacial vegetation with a specific emphasis on burning organized by hunter-gatherers. HUMLAND integrates various spatial datasets as input and target for the agent-based model results. Additionally, the simulation incorporates recently obtained continental-scale estimations of fire return intervals and the speed of vegetation regrowth. The obtained results include maps of possible scenarios of modified landscapes in the past and quantification of the impact of each agent, including climate, humans, megafauna, and natural fires.

The various technologies used inside a Dutch greenhouse interact in combination with an external climate, resulting in an emergent internal climate, which contributes to the final productivity of the greenhouse. This model examines how differing technology development styles affects the overall ability of a community of growers to approach the theoretical maximum yield.

ForagerNet3_Demography_V3

Andrew White | Published Tuesday, November 29, 2016The ForagerNet3_Demography model is a non-spatial ABM designed to serve as a platform for exploring several aspects of hunter-gatherer demography.

Agent-based model for the socio-economic monitoring of visitor streams

Stefan Mohr | Published Saturday, January 20, 2018Due to the large extent of the Harz National Park, an accurate measurement of visitor numbers and their spatiotemporal distribution is not feasible. This model demonstrates the possibility to simulate the streams of visitors with ABM methodology.

An agent-based approach to weighted decision making in the spatially and temporally variable South African Paleoscape

Colin Wren | Published Thursday, December 29, 2016This model simulates a foraging system based on Middle Stone Age plant and shellfish foraging in South Africa.

MedLanD Modeling Laboratory

C Michael Barton Sean Bergin Isaac Ullah Gary Mayer Hessam Sarjoughian Helena Mitasova | Published Friday, May 08, 2015 | Last modified Thursday, December 14, 2017The MML is a hybrid modeling environment that couples an agent-based model of small-holder agropastoral households and a cellular landscape evolution model that simulates changes in erosion/deposition, soils, and vegetation.

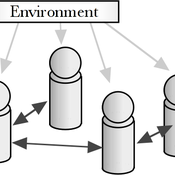

Political Participation

Didier Ruedin | Published Saturday, April 12, 2014 | Last modified Sunday, September 28, 2025Implementation of Milbrath’s (1965) model of political participation. Individual participation is determined by stimuli from the political environment, interpersonal interaction, as well as individual characteristics.

Segregation and Opinion Polarization

Thomas Feliciani Andreas Flache Jochem Tolsma | Published Wednesday, April 13, 2016This is a tool to explore the effects of groups´ spatial segregation on the emergence of opinion polarization. It embeds two opinion formation models: a model of negative (and positive) social influence and a model of persuasive argument exchange.

Emission Trading Impact On Power Generation Model

Emile Chappin | Published Friday, June 19, 2020Under the Kyoto Protocol, governments agreed on and accepted CO2 reduction targets in order to counter climate change. In Europe one of the main policy instruments to meet the agreed reduction targets is CO2 emission-trading (CET), which was implemented as of January 2005. In this system, companies active in specific sectors must be in the possession of CO2 emission rights to an amount equal to their CO2 emission. In Europe, electricity generation accounts for one-third of CO2 emissions. Since the power generation sector, has been liberalized, reregulated and privatized in the last decade, around Europe autonomous companies determine the sectors’ CO2 emission. Short-term they adjust their operation, long-term they decide on (dis)investment in power generation facilities and technology selection. An agent-based model is presented to elucidate the effect of CET on the decisions of power companies in an oligopolistic market. Simulations over an extensive scenario-space show that there CET does have an impact. A long-term portfolio shift towards less-CO2 intensive power generation is observed. However, the effect of CET is relatively small and materializes late. The absolute emissions from power generation rise under most scenarios. This corresponds to the dominant character of current capacity expansion planned in the Netherlands (50%) and in Germany (68%), where companies have announced many new coal based power plants. Coal is the most CO2 intensive option available and it seems surprising that even after the introduction of CET these capacity expansion plans indicate a preference for coal. Apparently in power generation the economic effect of CO2 emission-trading is not sufficient to outweigh the economic incentives to choose for coal.

Peer reviewed Price Evolution with Expectations

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

Displaying 10 of 219 results for "Martin Neumann" clear search