About the CoMSES Model Library more info

Our mission is to help computational modelers at all levels engage in the establishment and adoption of community standards and good practices for developing and sharing computational models. Model authors can freely publish their model source code in the Computational Model Library alongside narrative documentation, open science metadata, and other emerging open science norms that facilitate software citation, reproducibility, interoperability, and reuse. Model authors can also request peer review of their computational models to receive a DOI.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with additional detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 8 of 8 results pricing clear search

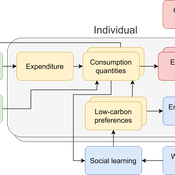

The cultural multiplier of climate policy

Daniel Torren-Peraire | Published Thursday, October 31, 2024For deep decarbonisation, the design of climate policy needs to account for consumption choices being influenced not only by pricing but also by social learning. This involves changes that pertain to the whole spectrum of consumption, possibly involving shifts in lifestyles. In this regard, it is crucial to consider not just short-term social learning processes but also slower, longer-term, cultural change. Against this background, we analyse the interaction between climate policy and cultural change, focusing on carbon taxation. We extend the notion of “social multiplier” of environmental policy derived in an earlier study to the context of multiple consumer needs while allowing for behavioural spillovers between these, giving rise to a “cultural multiplier”. We develop a model to assess how this cultural multiplier contributes to the effectiveness of carbon taxation. Our results show that the cultural multiplier stimulates greater low-carbon consumption compared to fixed preferences. The model results are of particular relevance for policy acceptance due to the cultural multiplier being most effective at low-carbon tax values, relative to a counter-case of short-term social interactions. Notably, at high carbon tax levels, the distinction between social and cultural multiplier effects diminishes, as the strong price signal drives even resistant individuals toward low-carbon consumption. By varying socio-economic conditions, such as substitutability between low- and high-carbon goods, social network structure, proximity of like-minded individuals and the richness of consumption lifestyles, the model provides insight into how cultural change can be leveraged to induce maximum effectiveness of climate policy.

A replication and extension of the Taylor's Simulation Model of Insurance Market Dynamics in C#

Rei England | Published Sunday, September 24, 2023A simple model is constructed using C# in order to to capture key features of market dynamics, while also producing reasonable results for the individual insurers. A replication of Taylor’s model is also constructed in order to compare results with the new premium setting mechanism. To enable the comparison of the two premium mechanisms, the rest of the model set-up is maintained as in the Taylor model. As in the Taylor example, homogeneous customers represented as a total market exposure which is allocated amongst the insurers.

In each time period, the model undergoes the following steps:

1. Insurers set competitive premiums per exposure unit

2. Losses are generated based on each insurer’s share of the market exposure

3. Accounting results are calculated for each insurer

…

Long Term Impacts of Bank Behavior on Financial Stability An Agent Based Modeling Approach

Ilker Arslan | Published Tuesday, October 13, 2015 | Last modified Monday, April 08, 2019This model simulates a bank - firm credit network.

Double Auction

Timothy Gooding | Published Sunday, February 24, 2019This model reproduces the double auction experiments and explores the difference between short-term and long-term trading and pricing.

Dynamic pricing strategies for perishable products in a competitive multi-agent retailer market

Wenchong Chen Hongwei Liu | Published Monday, November 27, 2017 | Last modified Thursday, March 01, 2018This model explores a price Q-learning mechanism for perishable products that considers uncertain demand and customer preferences in a competitive multi-agent retailer market (a model-free environment).

A consumer-demand simulation for Smart Metering tariffs (Innovation Diffusion)

Martin Rixin | Published Thursday, August 18, 2011 | Last modified Saturday, April 27, 2013An Agent-based model simulates consumer demand for Smart Metering tariffs. It utilizes the Bass Diffusion Model and Rogers´s adopter categories. Integration of empirical census microdata enables a validated socio-economic background for each consumer.

01a ModEco V2.05 – Model Economies – In C++

Garvin Boyle | Published Monday, February 04, 2013 | Last modified Friday, April 14, 2017Perpetual Motion Machine - A simple economy that operates at both a biophysical and economic level, and is sustainable. The goal: to determine the necessary and sufficient conditions of sustainability, and the attendant necessary trade-offs.

(Policy induced) Diffusion of Innovations - An integrated demand-supply Model based on Cournot Competition

Martin Rixin | Published Monday, August 29, 2011 | Last modified Saturday, April 27, 2013Objective is to simulate policy interventions in an integrated demand-supply model. The underlying demand function links both sides. Diffusion proceeds if interactions distribute awareness (Epidemic effect) and rivalry reduces the market price (Probit effect). Endogeneity is given due to the fact that consumer awareness as well as their willingness-to-pay drives supply-side rivalry. Firm´s entry and exit decisions as well as quantity and price settings are driven by Cournot competition.