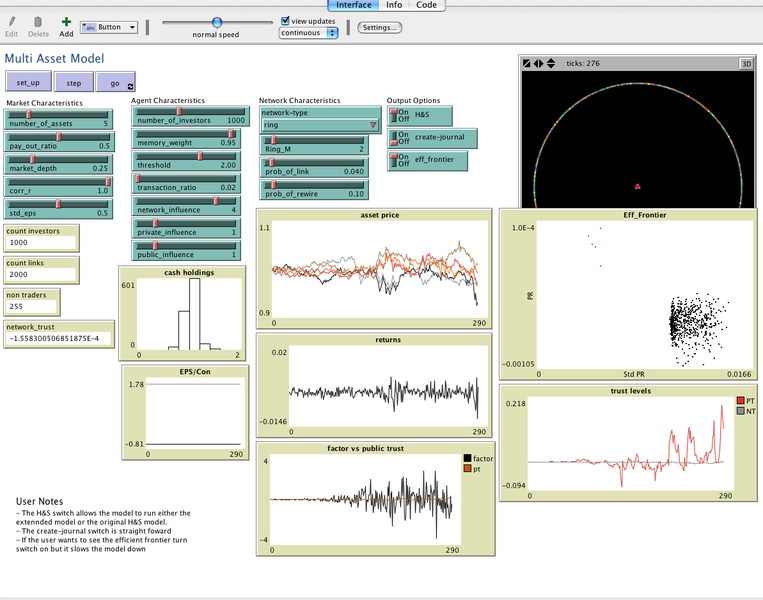

Multi Asset Variable Network Stock Market Model 1.1.0

The behavior of financial markets has, and continues, to frustrate investors and academics. With the advent of new approaches, including a complex systems framework, the search for an explanation as to how and why markets behavior as they do has greatly expanded. The use of agent-based models (ABMs) and the inclusion of network science has played an important role in increasing the relevance of the complex systems. Through the use of an artificial stock market utilizing an Ising model based agent-based model, this model is able to provide significant insight into the mechanisms that drive the returns in financial markets, including periods of elevated prices and excess volatility. In particular, the thesis demonstrates the following: the network topology that investors form; along with the dividend payout ratio of a stock significantly impact the behavior of the market. The model also investigates the impact of introducing multiple risky assets, something that has been absent in any previous models. By successfully addressing these issues this thesis has helped refine and shape a variety of further research tasks.